Automate collection reconciliation, prevent revenue leakage.

Non-banking financial lending institutions face challenges in loan repayment reconciliation: errors, delays, financial mismatches, and compliance burdens. Our AI-powered automation solution addresses key reconciliation processes for seamless operational efficiency.

Operational and Compliance Excellence

Universal Compatibility

Achieve seamless loan repayment reconciliation for all your financial lending products

Intelligent Automation

Leverage out of the box loan reconciliation rules library for unparalleled accuracy.

Comprehensive Integration

Benefit from ready connectors for payment gateways and other payment methods.

Real-Time Visibility

Gain immediate insights with a real-time dashboard for loan repayment tracking and reconciliation status.

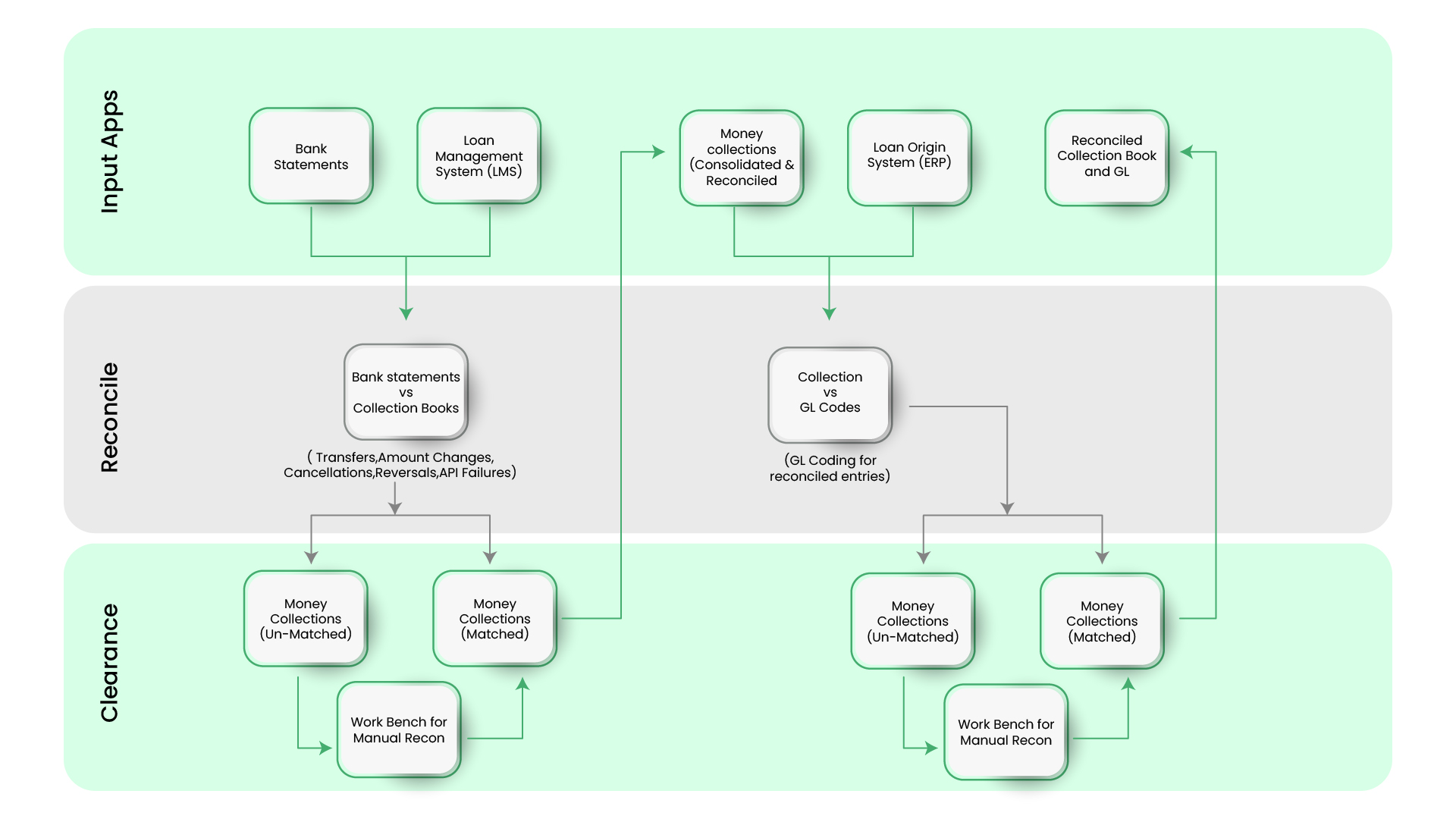

Reconciliation Journey

Core Functionalities

Key Advantages:

Operational Excellence

Automate manual processes with intelligent digital banking reconciliation automation. Enhance efficiency in microfinance repayment tracking and all lending sectors.

Improved Financial Health

Achieve accurate loan repayment reconciliation, reducing discrepancies. Optimize collections with AI-driven collections reconciliation.

Enhanced Risk Mitigation

Implement a real-time automated loan repayment monitoring system. Improve overdue loan tracking system capabilities.

Regulatory Adherence

Regulatory AdherenceEnsure regulatory compliance for loan repayment with comprehensive reporting and transparent documentation.

Key Features Driving Efficiency

-

Smart Automation: AI-powered loan reconciliation for superior

accuracy./span>

Smart Automation: AI-powered loan reconciliation for superior

accuracy./span>

-

Unified View: Real-time dashboard for loan tracking and

reconciliation.

Unified View: Real-time dashboard for loan tracking and

reconciliation.

Proactive Monitoring: Automated monitoring system for potential

defaults.

Proactive Monitoring: Automated monitoring system for potential

defaults.

Predictive Intelligence: Predictive analytics for loan

collections.

Predictive Intelligence: Predictive analytics for loan

collections.

Payment Flexibility: Support for credit card payment

reconciliation and various

payment gateways.

Payment Flexibility: Support for credit card payment

reconciliation and various

payment gateways.

Who Will Benefit Most?

NBFCs: Streamline NBFC loan reconciliation software processes.

Microfinance Institutions: Enhance microfinance repayment tracking.

Alternative Lenders: Optimize alternative lending loan payment tracking.

Digital Banks: Leverage digital banking reconciliation automation.

All Financial Institutions: Improve overall end-to-end financial reconciliation.

Ready to Experience Intelligent Loan Reconciliation?

Transform Your Financial Operations: Request a Free Demo of Our FinTech Reconciliation Solution.